san antonio tax rate property

If the city reduces its tax rate it would need the approval of council as it adopts is budget in September and it would take effect on Jan. For questions regarding your tax statement contact the Bexar County Tax.

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tax Rates The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction.

. Learn all about San Antonio real estate tax. The cap used to be 8 before SB2 went into effect. If there is a decrease in the citys property tax rate currently set at 558 cents per 100 of property value it would take effect in January next year.

Legislators in 2019 passed Senate Bill 2 which mandates a property tax rate rollback if property tax revenues go about 35 over the previous year. Tax statements are then sent to all property owners. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value.

The FY 2022 Debt Service tax. 2 voted against the measure while Commissioners Trish DeBerry Pct. 1 the market value of the property.

Whether you are already a resident or just considering moving to San Antonio to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Northeast - 3370 Nacogdoches Rd. The property tax rate for the City of San Antonio consists of two components.

One Simple Search Gets You a Comprehensive San Antonio Property Report. Taxing entities include San Antonio county governments and a number. 4 and Bexar County Judge Nelson.

Overall there are three phases to real estate taxation namely. 0125 dedicated to the City of San Antonio Edwards Aquifer Protection and Parks Development and Expansion Venue Projects. Weve been awarded the Certificate of Excellence in Assessment Administration by IAAO and recognized as a Top Workplace for 2019 2020 and 2021 by San Antonio Express-News.

Commissioners Rebeca Clay-Flores Pct. Truth in Taxation Summary PDF. After much back-and-forth the new proposed property tax rate for Bexar County is now 0299999 per 100 valuation a reduction of just under 001098 cents.

Northwest - 8407 Bandera Rd. That includes the city school and municipal utility rate but does not include any special districts. 254 rows In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261.

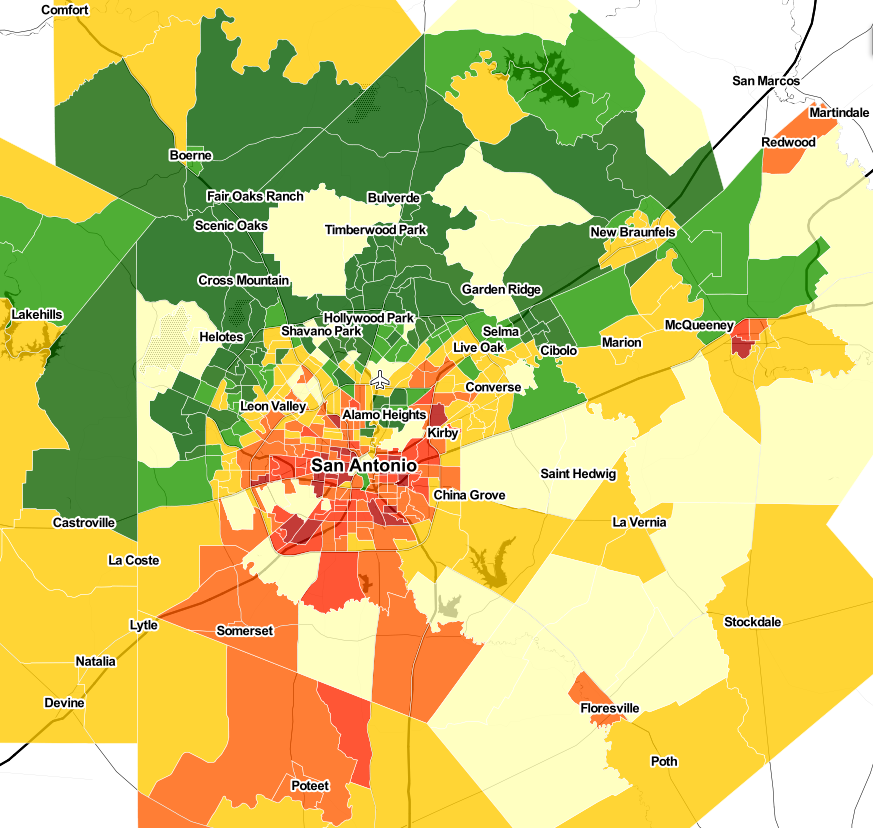

Throughout Bexar county of which San Antonio is the dominant player tax rates can vary between 12 and 14. The property tax rate for the City of San Antonio consists of two components. San antonio property tax rate 2019 Friday March 11 2022 Edit.

Official Tax Rates Exemptions for each year. San Antonios current sales tax rate is 8250 and is distributed as follows. Tax bills in San Antonio typically increase because of climbing property values or school district rate increases.

The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. Information on property tax calculations and delinquent tax collection rates. A 10 percent of the.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. Its currently set at 556 cents per 100 of valuation. 1000 City of San Antonio.

Deadlines and important tax dates. The citys tax rate has been at nearly 056 since 2016. Maintenance Operations MO and Debt Service.

Ad Discover San Antonio Property Records Now. Staff say the city has not raised the tax rate in 29 years and has lowered it seven times. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details.

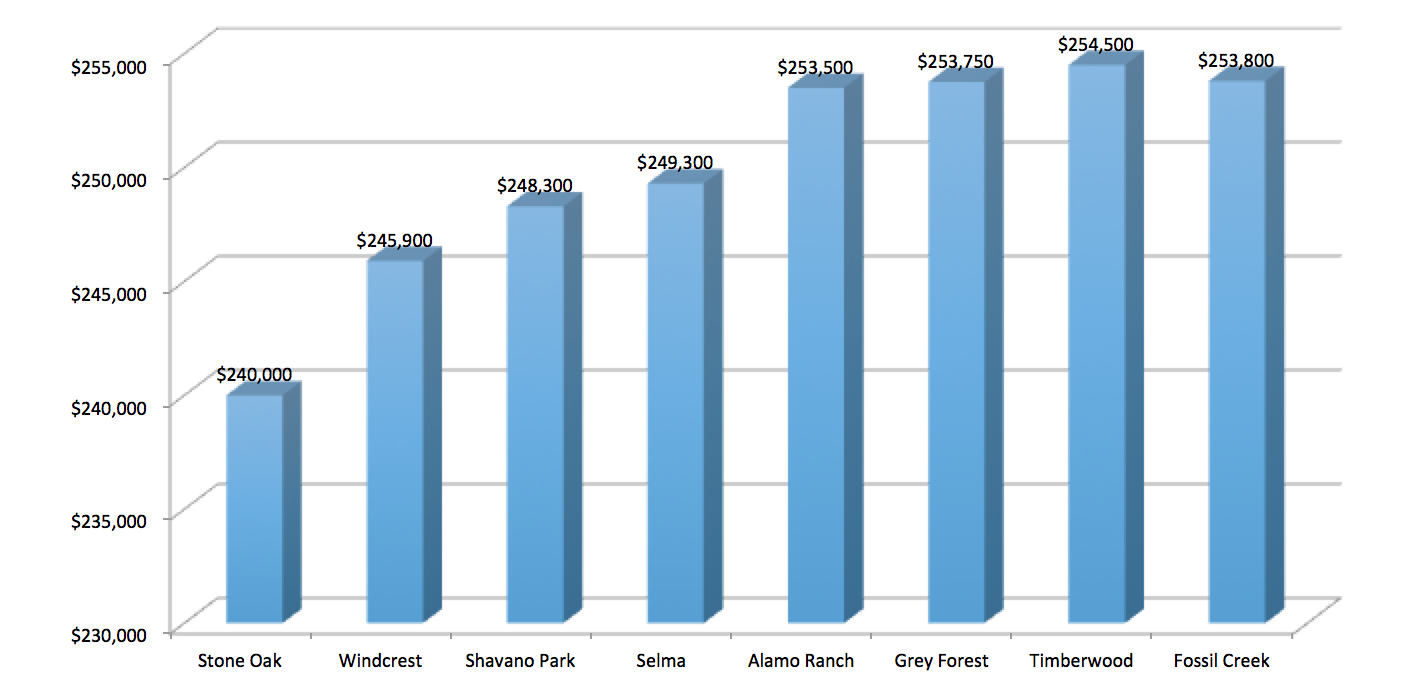

1 and Justin Rodriguez Pct. House Numerology Lucky Real Estate Pricing Real Estate 101 Trulia Blog House Numerology Real Estate Estates Your 365 Day Mortgage Rate Forecast Mortgage Rates Real Estate Trends Mortgage. Homeowners in neighborhoods such as Alamo Ranch Timberwood Park Fossil Creek Redbird Ranch and many others have historically fought in order to combat annexation by the city.

Property Tax Code Section 2323a sets a limit on the appraised value of a residence homestead stating that its appraised value for a tax year may not exceed the lesser of. 33 rows San Antonio citiestowns property tax rates The following table provides 2017 the most common. Each unit then is given the tax it levied.

Maintenance Operations MO and Debt Service. Or 2 the sum of. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

0250 San Antonio ATD. 3 Tommy Calvert Pct. San Antonio residents pay almost 57 cents in property taxes per every 100 dollars.

Southside - 3505 Pleasanton Rd. Although its too soon to be certain current projections show the City of San Antonio could reduce its tax rate in 2023. Information on taxes paying taxes and how to manage your taxes.

34677 cents per 100. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

The tax rate varies from year to year depending on the countys needs. Setting tax rates appraising property worth and then receiving the tax. Keeping in mind that San Antonios city property tax rate is 55 per hundred dollars eliminating this line item could be huge and it is in many areas.

You Just Need a Full Address to Start. The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value. 48 rows San Antonio.

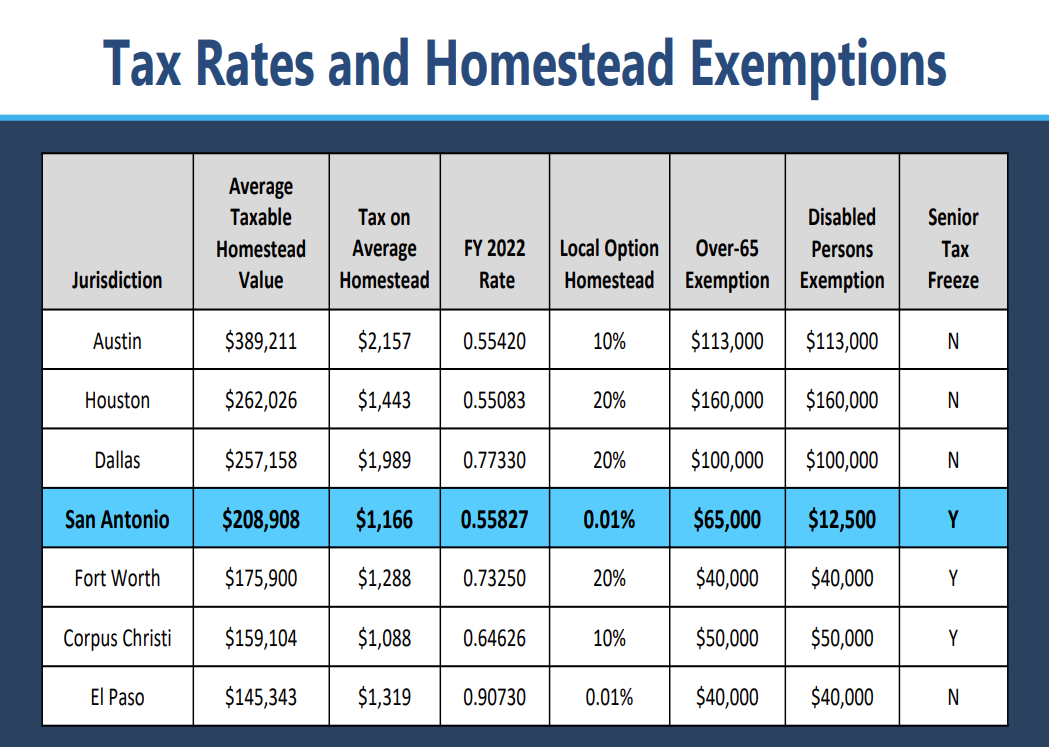

This compares favorably with other parts of the state.

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Bexar County Commissioners Approve Slightly Reduced Tax Rate For 2022

Tax Rates Bexar County Tx Official Website

Tac School Property Taxes By County

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Bexar County Commissioners Approve Symbolic Property Tax Cut

San Antonio Property Tax Rates H David Ballinger

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Tac School Property Taxes By County

Tac School Property Taxes By County

San Antonio Real Estate Market Stats Trends For 2022

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption