pay indiana fuel tax online

The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT. Take the renters deduction.

Ifta Reporting Software Ifta Filing Online Quarterly Fuel Tax Reporting

This search may take over three 3 minutes.

. Pay my tax bill in installments. Find Indiana tax forms. We highly recommend that you access the web sites on certified browsers for all features to work accurately.

Indiana IFTA online fuel tax filing made easy. The transaction fee is 25 of the total balance due. Click the button below to view details on three IN fuel tax.

Indiana IFTA Quarterly Fuel Tax Report IFTA Online Filing. Cookies are required to use this site. Have more time to file my taxes and I think I will owe the Department.

Users must have a current fuel tax account. You do not need to create an INTIME logon to make a payment. More information is available in the Electronic Payment Guide.

Claim a gambling loss on my Indiana return. It also helps to maintain your trip sheet for IFTA Audit. Your browser appears to have cookies disabled.

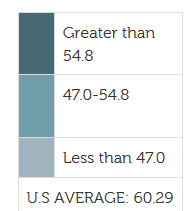

Indianas excise tax on gasoline is ranked 19 out of the 50 states. Filing and Paying Taxes Indianas free online tool to manage business tax obligations. Know when I will receive my tax refund.

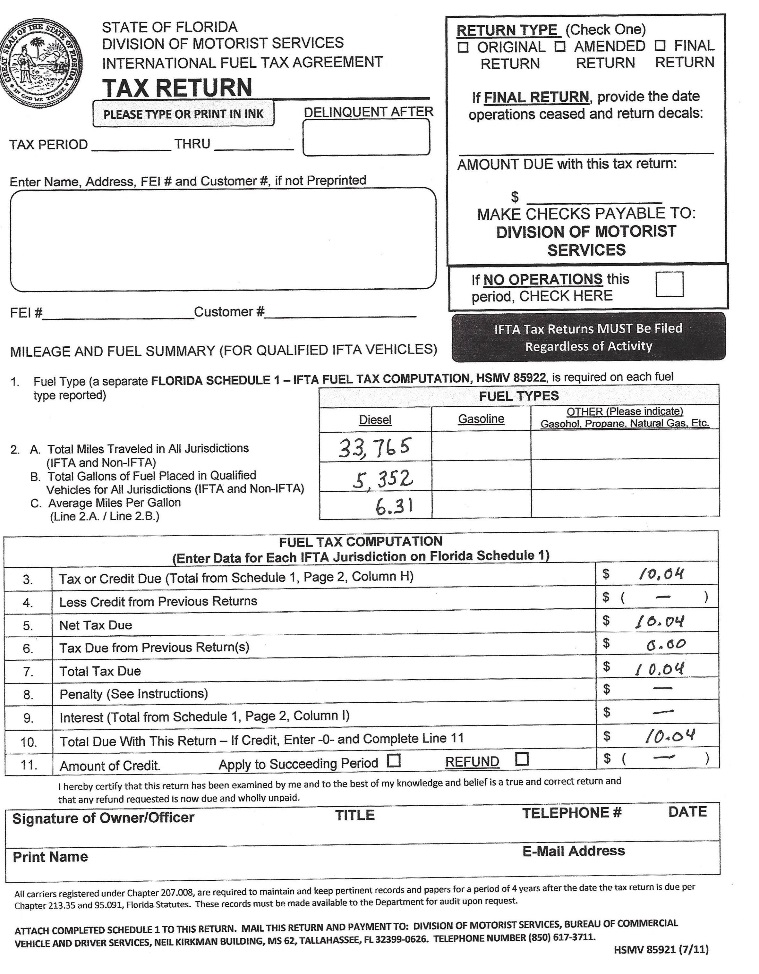

Increase in Gasoline License Tax and Special Fuel License Tax PL. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. The Indiana Department of Revenue Motor Carrier Services Division Fuel Tax System software provides a browser-based means of taxation and motor carrier registration with internal access for support functions auditing and decal shipments and external access for motor carriers and service bureaus to self-maintain a portion of their accounts.

Indiana Fuel Tax Reports. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT. Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction.

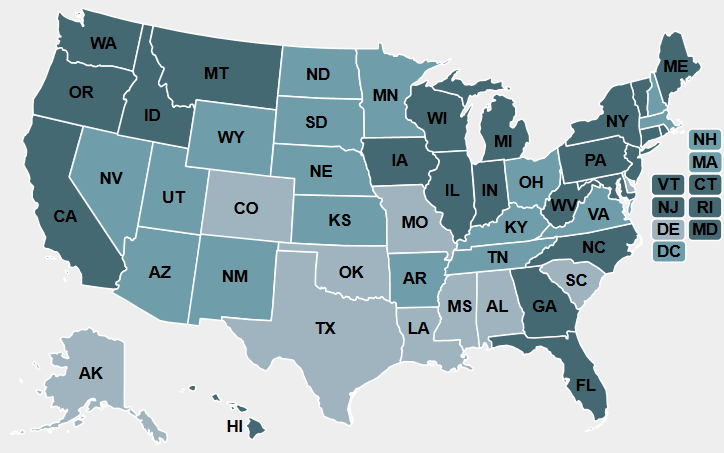

Know when I will receive my tax refund. Click the button below to view details on three IN fuel tax reports. Locate your states website.

Motor carrier customers can manage all of their IFTA and MCFT transactionsincluding processing and paying quarterly tax returns renewals and ordering additional decalsonline 247 by using the Fuel Tax System. Claim a gambling loss on my Indiana return. The Indiana gas tax is included in the pump price at all gas stations in Indiana.

Fuel Taxes - IFTAMCFT. Take the renters deduction. Pay my tax bill in installments.

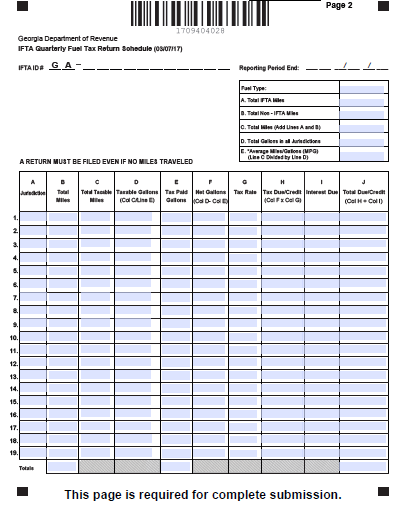

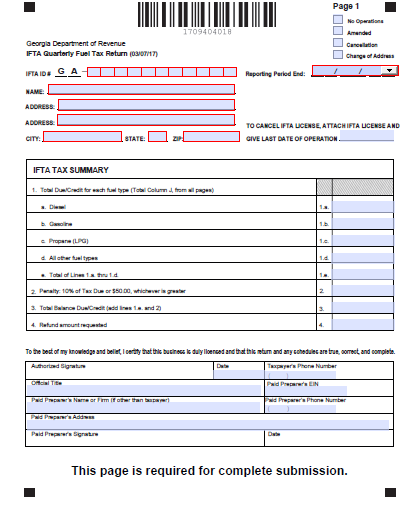

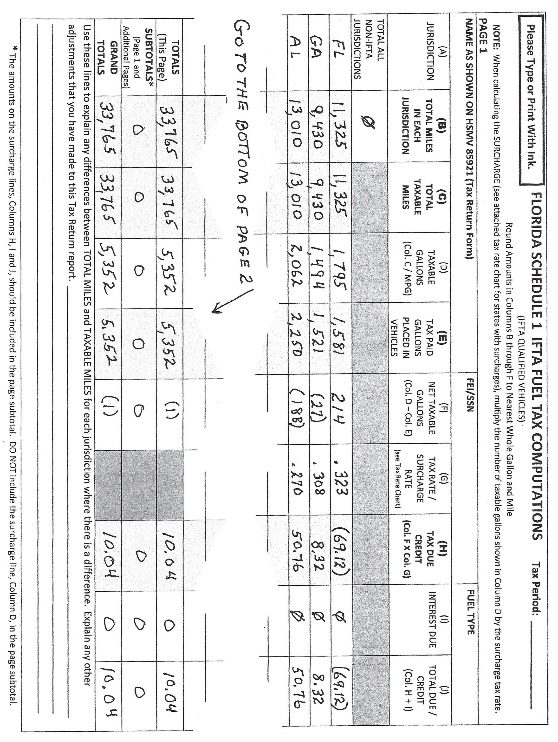

Online application to prepare and file Quarterly IFTA return for Indiana State. Online Fuel Tax System. Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal.

Prepaid Gasoline Sales Tax Rate Effective April 1 2022 the new prepaid gasoline sales tax rate is 176 cents per gallon. The online Indiana Fuel Tax System offers motor carriers the ability to manage all of their MCFTIFTA transactions with Motor Carrier Services online. Effective July 19 th 2021 you will be able to access Indiana DOR Motor Carrier web sites only on certified browsers.

218-2017 requires the department to publish the new rates effective July 1 2022 for the gasoline license tax IC 6-6-11-201 and special fuel license tax IC 6-6-25-28 on the. Have more time to file my taxes and I think I will owe the Department. Please read our handy step-by-step guide Make a Bill Payment Without Logging in to INTIME then visit intimedoringov to get started.

19th highest gas tax. With accurate fuel tax calculations you can quickly generate your IFTA report keep track of fuel purchases with ExpressIFTA. More information is available in the Electronic Payment Guide.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. The system was designed to provide motor carriers with a single source for all their fuel tax reporting in Indiana. The Indiana excise tax on gasoline is 1800 per gallon higher then 62 of the other 50 states.

Fuel producers and vendors in Indiana have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Indiana government. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. You can find your amount due and pay online using the intimedoringov electronic payment system.

Texas State IFTA Fuel Tax File IFTA Return Online IFTA Tax DOR. PUC Claim forms -- Due by the due date of the quarter in which you are applying for credit. Find Indiana tax forms.

Establish a new account. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Transaction Fees are Non-Refundable.

The due dates for filing and paying your quarterly tax returns are. Fuel tax is due on the 20th of each month for the previous month or the last day of the month every three months for motor carriers road tax. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

How Long Has It Been Since Your State Raised Its Gas Tax Itep

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LJK5RFTL75N77PLOMK4DEVPUJQ.jpg)

Explainer Biden S U S Fuel Tax Holiday Plan No Easy Relief For Gas Prices Reuters

Ifta Inc International Fuel Tax Association

Fuel Permits Ifta Permit Temporary Ifta Permits

Fuel Permits Ifta Permit Temporary Ifta Permits

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Ifta Fuel Tax Reporting Services 800 498 9820

Fuel Permits Ifta Permit Temporary Ifta Permits

Trucking 101 How To File Fuel Tax Return Quarterly Ifta Youtube

3 Ways To Pay Ifta Taxes Online Wikihow

Fuel Permits Ifta Permit Temporary Ifta Permits

How To File And Pay Your Ifta Fuel Tax Youtube

Fuel Permits Ifta Permit Temporary Ifta Permits